Blockpit - Crypto taxation app for iPhone and iPad

Developer: Blockpit GmbH

First release : 28 Feb 2019

App size: 6.06 Mb

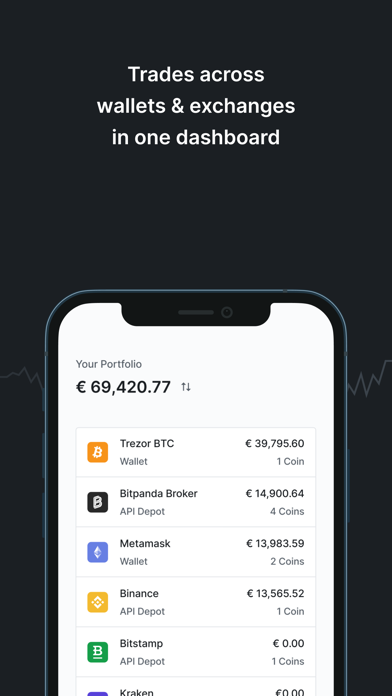

Blockpit provides portfolio tracking and tax calculation for cryptocurrencies in one clear dashboard. Automatically sync your transactions through API access and keep track of trades across wallets and exchanges. The tax calculation is audited by KPMG, which makes Blockpit one of the most trusted software to monitor & calculate crypto taxes.

What is Blockpit:

With Blockpit you can track your portfolio in real-time, monitor profits/losses, calculate taxes and keep track of your crypto trades on the go. Save time by using Blockpit and download your tax report as a proof of origin for banks and authorities. Have a look at our features:

Portfolio Tracking

- All trades & incomes combined in one dashboard

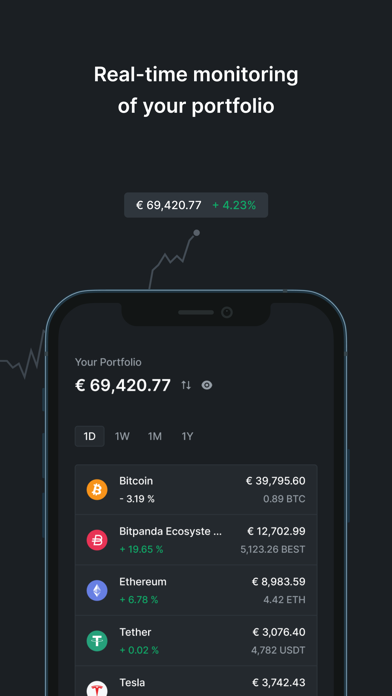

- Real-time monitoring of portfolio development

- Complete transaction history as proof of origin for banks

- Active tranches tab exactly shows your current profits/losses and holding periods

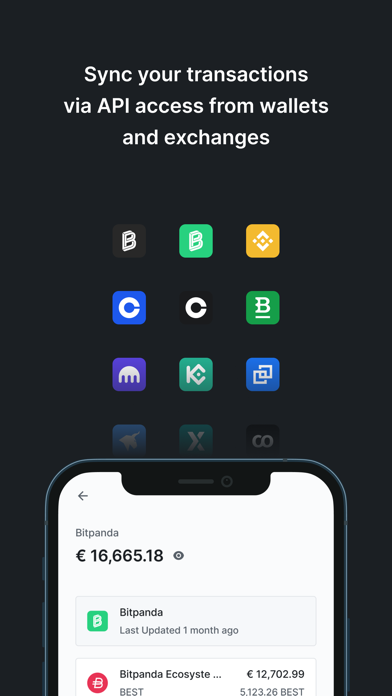

Automatic Import

- Quick dashboard setup through automatic sync

- Intelligent error handling

- Imports via API keys from exchanges, ETH wallets and ERC-20 smart contracts

- Choose between HIFO, FIFO, LIFO and other calculation methods

- Get a complete report for your tax returns

Download verified tax document

- Complete report as PDF-Download

- KPMG assessed platform & calculation methods

- All data as document for the tax return

Directly import your trades through the mobile app or through our web application app.blockpit.io from our supported exchanges: Binance, Bitcoin.de, Bitfinex, Bitpanda, Bitstamp, Bittrex, Coinbase, Coinbase Pro, Coinfinity, Cryptopia, HitBTC, Huobi, Livecoin, Kraken, Kucoin, Poloniex. We are constantly working on integrating further exchanges.

If you like the app we would be pleased about a positive rating :) In addition we would appreciate your feedback, ideas and suggestions so we can adapt our platform to your needs. Please write us therefore an email to [email protected].